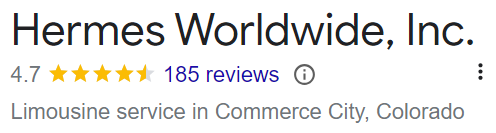

Hermes Worldwide is a vibrant company providing chauffeured transportation solutions to clientele in a wide array of industries and markets. The company is both a woman and minority-owned business benefiting clientele who want to diversify their suppliers. Through the adoption of fresh ideas and impeccable service standards Hermes is fast becoming a supplier of choice providing world class chauffeured transportation worldwide.

Sanja was a truly fantastic help and asset with pulling together a special day for a very special couple! She helped with multiple manifest adjustments (and we had many), and her team of drivers were incredibly communicative and kind on the big day. I look forward to working with them in the future.

Alexandra M.

We loved our experience working with Hermes! Their communication and service is top notch and their vehicles are clean and well maintained. We will continue to use them and recommend them in the future.

Lindsey M.

We custom tailor our services to meet your unique needs.

We custom tailor our services to meet your unique needs.

We provide worldwide airport service to over 400 major U.S. destinations, regional airports, and international cities. Imagine being able to place one call to arrange all of your transportation needs?

As the world’s leading brewery tour provider, we offer various options to choose from in Denver, CO, and beyond.

Whether you’re looking to charter a bus for a day trip or need a rental for a cross-country tour, we’ve got you covered. We offer a wide range of charter and rental services that are perfect for any group size.

If you are about to plan a citywide convention or large group event and are looking for the best in class ground transportation services, look no further than Hermes Worldwide.

There are many different ways that you can get to these concert venues, but our Denver Concert Transportation Services are the best way to get there.

Enters Hermes Worldwide—your partner in achieving a new echelon of Corporate Transportation Denver and beyond.

Your best option is to choose Hermes Worldwide for your cruise terminal transportation needs. We provide private and group transportation to and from the cruise terminal for our clients in Denver, CO, as well as around the world.

When you choose Hermes Worldwide for your Denver Roadshow Transportation needs, you can expect nothing but the best. We will work closely with you to understand your specific needs and requirements.

Our team specializes in military and government transportation in Denver & Worldwide, providing safe and reliable transportation for our state’s military and government officials.

We’ve been in business for many years now, and we’ve built a reputation as the best group transportation provider in Denver and beyond.

If you’re visiting Denver, Colorado, during the holidays, be sure to check out one of the many holiday lights tours. Hermes Worldwide is happy to help you plan the perfect holiday lights tour for your group.

You might be asking yourself, “What is an hourly car service?” Well, it’s simple, really. It’s a professional chauffeur that you can hire to drive you around for a specified amount of time, usually by the hour.

Our Denver Meeting or Event Transportation Service is an ode to seamless coordination and impeccable timing, encapsulating the very essence of Denver’s corporate dynamism.

Our night-on-town transportation service will offer you the chance to explore the town in a more complete way. You will be able to see the sights and sounds that you would not be able to experience with public transportation.

Non-emergency medical transportation is vital for those of us who can’t drive ourselves to and from doctor’s appointments. This means we don’t have to put others at risk by driving when we’re not supposed to.

Embarking on Denver City Tours elevates you from mere visitor status to that of a privileged explorer, enveloped in the luxury of our premium vehicles.

Understandably, finding a home is a big choice. To support you in making the best decision possible, we offer real estate tours in Denver. Get more information by contacting us today.

We know that each school and college has different transportation needs. That is why we offer customizable school/college transportation in Denver, CO & worldwide.

We offer a wide range of shuttle services in Denver & Worldwide that can be tailored to your specific needs. Whether you need a one-way trip or a round trip, we have you covered.

We’re here to help you plan your perfect ski vacation and make sure that your Denver ski resort transportation is the least of your worries.

Hermes Worldwide offers a range of transportation services for all events at affordable prices. We may fit any number of people in our fleet of luxury cars since we have various options.

If you are planning on attending a sporting event, it is important to make sure that you have transportation arranged in advance. We can provide you with the best possible service and make sure that you get to your destination safely and on time.

Whether you need a small van for a youth team or a large bus for a professional team, we have you covered. We understand that each team is unique and has different transportation needs.

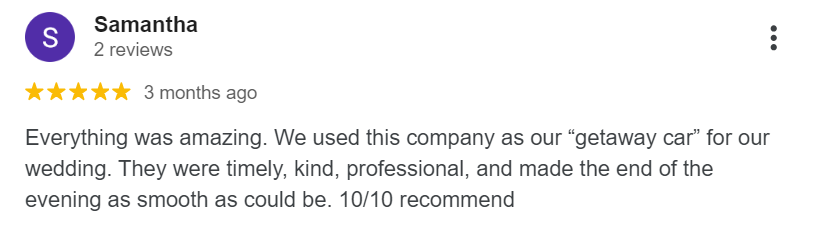

Our wedding transportation in Denver is more than just a ride; it’s a bespoke journey tailored to the unique dreams of each couple. We believe in transforming the essential into the extraordinary, ensuring that every mile traveled with us is imbued with luxury, comfort, and a touch of magic.

We offer wine tours in Denver and many other cities around the world. We can also customize a tour to fit your needs, whether you’re looking for a romantic getaway or a group outing. Whatever you’re looking for, we’re here to help.

If you are looking for a safe, reliable, and affordable transportation option for your youth or church group, look no further than Hermes Worldwide.

Embark on our Denver Whiskey Tour, where each sip tells a story as rich and compelling as the city. Picture Denver, Colorado – a tapestry of urban sophistication and rugged mountain beauty, crafting the perfect backdrop for an odyssey into the world of whiskey. This journey is more than just a tour; it’s a voyage through the heart of Denver’s culture, intertwined with the golden allure of its finest spirits.

Greetings, discerning travelers of Denver and beyond. It’s not by chance that you’ve landed here; your quest for impeccable and luxurious transportation has brought you to the right place – Hermes Worldwide. We extend beyond traditional car services’ confines; we embody elevated travel, combining professionalism, reliability, and an unmatched sense of style.

In the fast-paced world of today, every second counts. Here at Hermes Worldwide, we understand the essence of time. We cater to Denver’s elite’s dynamic, time-sensitive needs – from the busy executives making strides in their industries to the vibrant socialites marking their territory. With our Denver Car Service, your destination may be the journey’s purpose, but we ensure it is just as fulfilling.

Aboard our vehicles, the hustle and bustle of Denver’s city life morph into a peaceful backdrop. It’s about enhancing productivity for the executive rushing to close a deal, providing a moment of tranquility for the parent headed to a family event, or offering a luxurious preamble to the socialite’s extravagant evening. We strive to accentuate these experiences with seamless transportation, letting you focus on what truly matters.

For those seeking to transform their journey into an unforgettable experience, we are always available with our Denver Limo Service. We’ve left no stone unturned in our quest to provide an offering that exudes elegance and garners admiration. Limousines symbolize luxury, and our service amplifies this notion, transforming every ride into a majestic affair.

Our limousines are more than mere transport; they are dynamic spaces of comfort and class. Be it a grand entrance on your wedding day, making a statement at a high-profile event, or simply indulging in the finer things in life, our limousines serve as your personal statement of sophistication.

Bid farewell to the woes of airport commuting with our Denver Airport Transportation service. Designed to be reliable, timely, and extremely efficient, we aim to redefine your travel to and from the airport.

Our chauffeurs, seasoned professionals with a comprehensive understanding of Denver’s intricate layout, are your trusted companions. They’re there to ensure you catch that early morning flight or receive a warm welcome home, regardless of the hour. Unpredictable traffic and inclement weather won’t deter us; with Hermes, your timely arrival is our promise. We serve all major airports in the area: Denver International Airport (DEN), Colorado Springs Airport (COS), Grand Junction Regional Airport (GJT), Aspen-Pitkin County Airport (ASE), Eagle County Regional Airport (EGE) and more.

We don’t merely exist within the transportation industry; we aim to revolutionize it. Our unwavering commitment to continual improvement, exceptional customer service, and extensive global affiliate network set us apart. We don’t just meet client expectations; we endeavor to surpass them at every turn.

Hesitation is no longer an option; it’s time to embrace a superior travel experience. Let Hermes Worldwide redefine your notion of transport with our outstanding Denver Car Service and Denver Limo Service. Join us, and let your journey take flight. Welcome to a world of extraordinary journeys. Welcome to Hermes Worldwide, Denver.

Luxury airport transportation for the ASE, DEN, EGE, GJT and RIL Airports

Global Reach, Local Expertise